You’ve been scrolling through listings for weeks. You’ve found the one—the house with the kitchen island you’ve been dreaming about, the backyard perfect for summer barbecues, and enough space for that home office you desperately need.

Then you see the price tag. Your heart skips. You ask yourself, “Can I actually afford this?”

Here’s the truth: most people don’t know how to answer that question until they’re sitting in a lender’s office, and by then, they’ve already emotionally committed to a house or the vision of their ideal home, which they may not be able to afford comfortably.

Let me walk you through the real math—the formulas lenders use, the budget you can actually live with, and how to find your sweet spot before you fall in love with a house you cannot afford.

What Lenders Look At: The 28/36 Rule

Mortgage lenders use something called the 28/36 rule to decide how much they’ll allow you to borrow. Here’s how it works:

The 28% Rule (Front-End Ratio)

A good rule of thumb is to keep your total housing costs under 28% of your monthly pre-tax income.

Housing costs include:

- Mortgage principal and interest

- Property taxes

- Homeowners insurance

- HOA fees (if applicable)

- Private mortgage insurance (PMI) if you put down less than 20%

The 36% Rule (Back-End Ratio)

Your total monthly debt payments, including housing costs plus credit cards, student loans, car loans, and other debts, shouldn’t exceed 36% of your gross monthly income.

The percentages are based on Federal Housing Administration guidelines and are commonly used throughout the mortgage industry to evaluate borrower risk.

The Breakdown

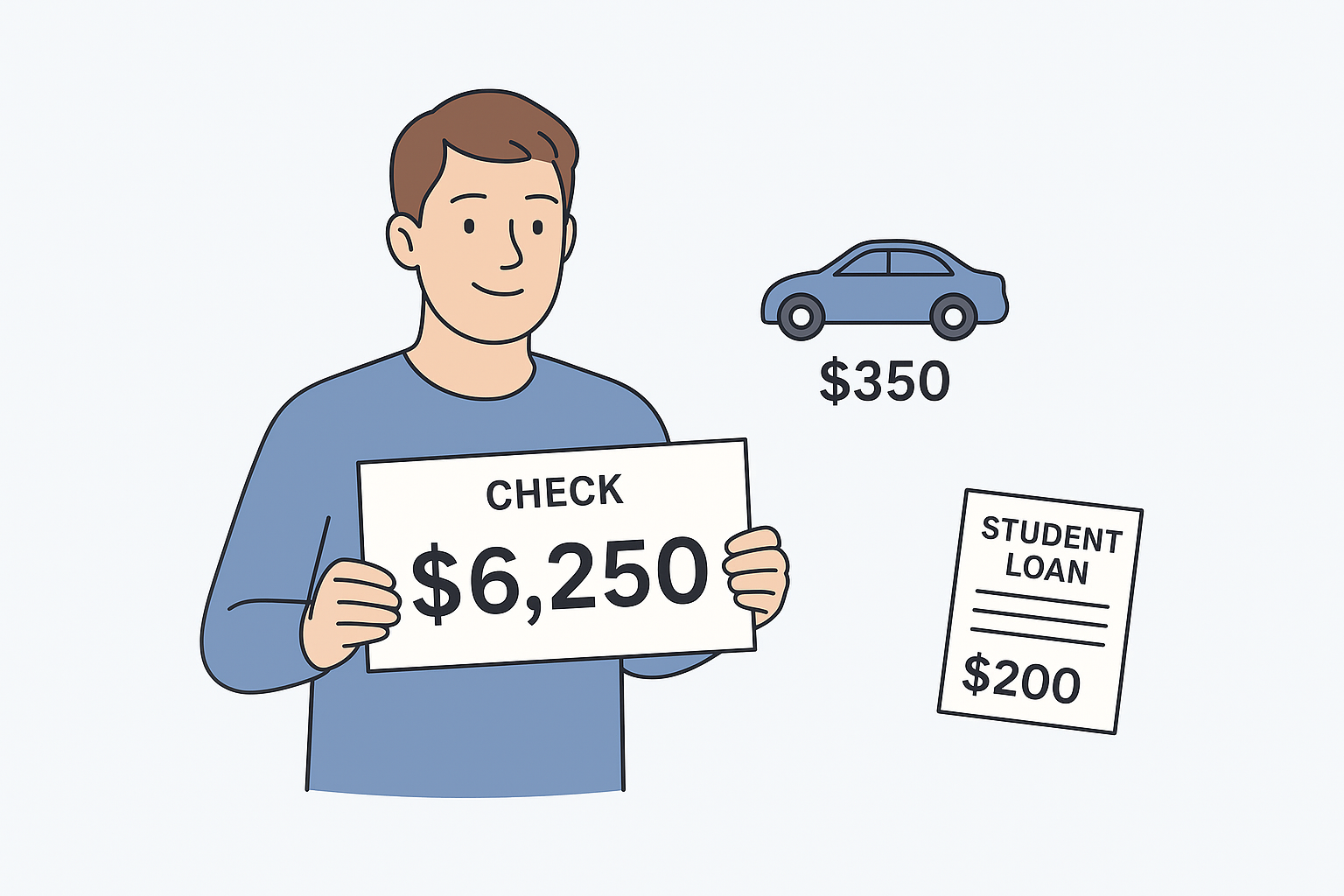

Meet Jordan, a single professional earning $75,000 annually.

Monthly Income: $75,000 ÷ 12 = $6,250

28% Rule (Housing):

Jordan should aim to spend no more than 28% of that on housing: $6,250 × 0.28 = $1,750

36% Rule (Total Debt):

All monthly debts combined shouldn’t exceed 36% of income: $6,250 × 0.36 = $2,250

Jordan already pays $350 for a car and $200 for student loans — that’s a total of $550 in monthly debt.

So, to stay within the 36% limit, Jordan’s housing costs should be no more than:

$2,250 − $550 = $1,700 a month.

Note that this is slightly below the 28% housing limit of $1,750. Lenders use whichever number is lower.

What does $1,700/month buy?

Using a mortgage calculator with an interest rate of 7%, a 30-year fixed mortgage, and accounting for property taxes (1.2% annually) and insurance ($100/month):

Jordan could afford a home for around $240,000 to $260,000, depending on the down payment and local tax rates.

Wait. Can You Comfortably Afford That?

Here’s where most advice stops. Lenders will tell you how much you can borrow, but not how much you should.

Just because you’re approved for a $1,700 monthly payment doesn’t mean it’s the right fit for your lifestyle. Ask yourself:

✓ Do you have an emergency fund of 3-6 months saved up?

✓ Are any big life changes (new job, grad school, or starting a family) coming up that can impact your income and expenses?

✓ Do you want financial breathing room? If you love to travel, eat out, or enjoy hobbies, keeping your housing costs lower can help maintain that freedom.

✓ Have you budgeted for maintenance? Owning a home means ongoing costs. Plan to set aside about 1–3% of your home’s value each year for repairs and upkeep.

Many financial advisors recommend keeping housing costs at around 25% of gross income to maintain breathing room in your budget, especially for first-time buyers who are still adjusting to homeownership expenses.

The Hidden Costs That Raise Your Monthly Payment

When figuring out what you can really afford, don’t just look at your mortgage and interest. Several other costs can add up fast:

| Cost | What It Is | Estimate Amount |

|---|---|---|

| Property Taxes | Annual tax based on home value, divided into monthly payments | 0.5%-2.5% of home value annually (varies by location) |

| Homeowners Insurance | Protects your home from damage | $80-$300/month depending on location & coverage |

| Private Mortgage Insurance (PMI) | Required if you put down less than 20% | 0.5%-1% of loan amount annually |

| HOA Fees | Community association dues (if applicable) | $100-$500+/month |

| Utilities | Electric, gas, water, trash, internet | $200-$400+/month |

| Maintenance Reserve | For repairs and unexpected breakdowns | 1%-4% of home value annually |

Example: On a $250,000 home with 5% down:

- Mortgage (principal + interest): ~$1,450/month

- Property taxes (1.5% annually): ~$312/month

- Insurance: ~$150/month

- PMI: ~$180/month

- Total: $2,092/month (before utilities and maintenance)

See how quickly it adds up beyond just the mortgage payment?

How to Calculate Your Personal Affordability Number

Calculate your realistic home price range using these steps:

Step 1: Calculate your gross monthly income.

Annual salary ÷ 12 = gross monthly income

Step 2: List all monthly debt payments: loans (car, student, and personal) and credit cards. Don’t include utilities or groceries, just debt obligations.

Step 3: Apply the 28/36 rule.

- Multiply gross monthly income × 0.28 = max housing payment

- Multiply gross monthly income × 0.36 = max total debt payment

- Subtract existing monthly debt from the 36% number

Step 4: Choose the lower number from Step 3.

Step 5: Subtract estimated property taxes, insurance, and Private Mortgage Insurance (PMI). What’s left is your actual mortgage payment (principal + interest).

Step 6: Use a mortgage calculator.

Input your mortgage payment amount, current interest rates, and loan term below to see your home price range.

Step 7: Adjust for comfort. If the number feels tight, reduce your target by 10-15% to allow for some breathing room.

What If You Can’t Afford What You Want?

If the math shows you’re not ready for your dream price range, you have options:

Option 1: Increase your down payment.

Putting more money down upfront reduces the amount you need to borrow, which means smaller monthly payments. Plus, if you put down at least 20%, you can skip paying PMI altogether.

Option 2: Pay down existing debt.

Reducing monthly debt obligations frees up room in your 36% ratio, allowing for a higher housing payment.

Option 3: Strengthen your credit score.

A better credit score can help you lock in lower interest rates, and that means smaller monthly payments. Even a half-point difference in your rate can save you hundreds each month.

Option 4: Look into first-time homebuyer programs.

Many state and local programs offer help with down payments or special low-interest loans for qualified buyers. It’s worth checking what’s available in your area.

Option 5: Adjust your timeline.

Sometimes, waiting 6-12 months to save more or improve your financial position can make homeownership more comfortable.

The Bottom Line

Affordability isn’t just about what a lender will approve. It’s about what lets you sleep well at night, enjoy your home, and still live the life you want.

Use the 28/36 rule as your starting point, then adjust based on your personal comfort level, lifestyle priorities, and financial goals. The right number is the one that feels sustainable, not just possible.

Your Action Plan

Before you start touring homes, determine your clear affordability number. Pull up your pay stubs, list your debts, and run the calculations.

Once you know what you can comfortably afford, you’ll be better prepared to house hunt with confidence and avoid falling in love with a home that keeps you up at night for the wrong reasons.

Sources:

- Consumer Financial Protection Bureau. (2023). Emergency Savings and Financial Security. CFPB.gov

- Freddie Mac. (October 2024). Primary Mortgage Market Survey. FreddieMac.com

- National Association of Realtors. (2024). Home Maintenance Cost Guidelines. NAR.realtor

- U.S. Department of Housing and Urban Development. (2024). FHA Loan Requirements and Debt-to-Income Ratios. HUD.gov